CHICAGO: Global auto industry conditions could potentially improve in 2022, with demand recovering further and supply chain challenges gradually easing, said Fitch Ratings.

According to the rating agency, semiconductor availability should modestly increase on a sequential basis through 2022 but supply chains remain vulnerable to potential event risk due to the trajectory of the pandemic.

“Our sector outlook is neutral and we expect that ratings in Fitch’s portfolio will generally remain unchanged. Most of our North American auto-related issuers will likely continue to focus on increasing earnings and cashflow, while maintaining strong liquidity,” said Fitch.

It said a portion of FCF may be allocated to shareholder returns and M&A but some issuers could also decide to reduce debt.

The European auto manufacturers’ credit profiles are expected to remain stable as leverage stays low and liquidity remains healthy, partially offsetting pressure on underlying profitability due to product mix normalization. APAC auto makers leverage is forecast to be stable to slightly improved.

Global sales are forecast to increase but are likely to remain about 6 percent below the 2019 pre-pandemic level. “We expect the supply/demand mismatch that led to very strong vehicle net pricing and mix in 2021 will continue in 1H22.

However, increased production and rebuilt inventories could lead to pricing, mix and margin normalization, in the latter half of 2022, which could cause original equipment manufacturers’ (OEM) operating margins to come under pressure,” said Fitch.

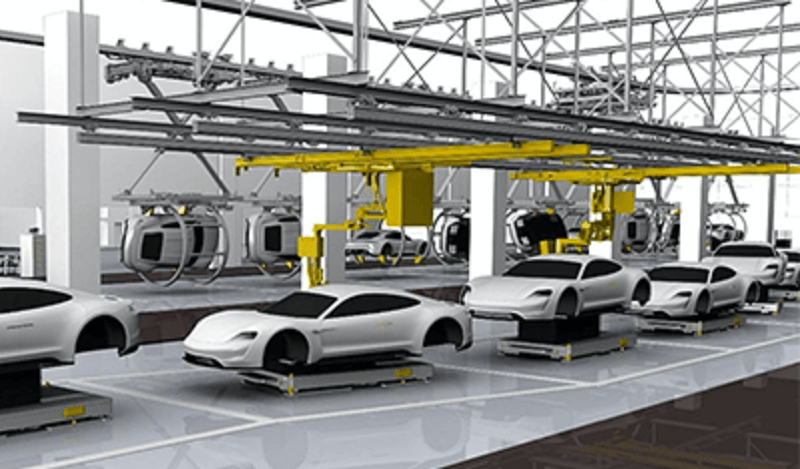

Other key items to watch in 2022 include increasingly stringent climate-related emissions regulations, rapid growth of electric vehicles (EV) and continued development of automated vehicles.

Fitch said that tightening emissions regulations and government incentives are likely to boost global EV sales next year. Although EV offerings are increasing and battery technology is improving, range anxiety is still a concern, and a slow expansion of the charging infrastructure could impede a major step-up in EV sales.

EV profitability does not yet match that of internal combustion vehicles and OEMs’ earnings and cash flows will remain burdened by further heavy technology investments over the next several years.